Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with end-stage renal disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD). The Centers for Medicare & Medicaid Services (CMS), a branch of the Department of Health and Human Services (HHS), is the federal agency that runs the Medicare program and monitors Medicaid programs offered by each state.

Different parts of Medicare help cover specific services:

| Part A (Hospital) | Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. There is no premium if you have worked a minimum of 10 years in Medicare-covered employment, and are eligible for Social Security benefits, though there are deductibles you must pay. |

| Part B (Medical) | Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. There are deductibles you must pay and a monthly Part B premium which is deducted from your Social Security benefits. |

| Part C (Medicare Advantage Plans) | A type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits. Medicare Advantage Plans include Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), Private Fee-for-Service Plans, Special Needs Plans, and Medicare Medical Savings Account Plans. If you’re enrolled in a Medicare Advantage Plan, most Medicare services are covered through the plan and aren’t paid for under Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. |

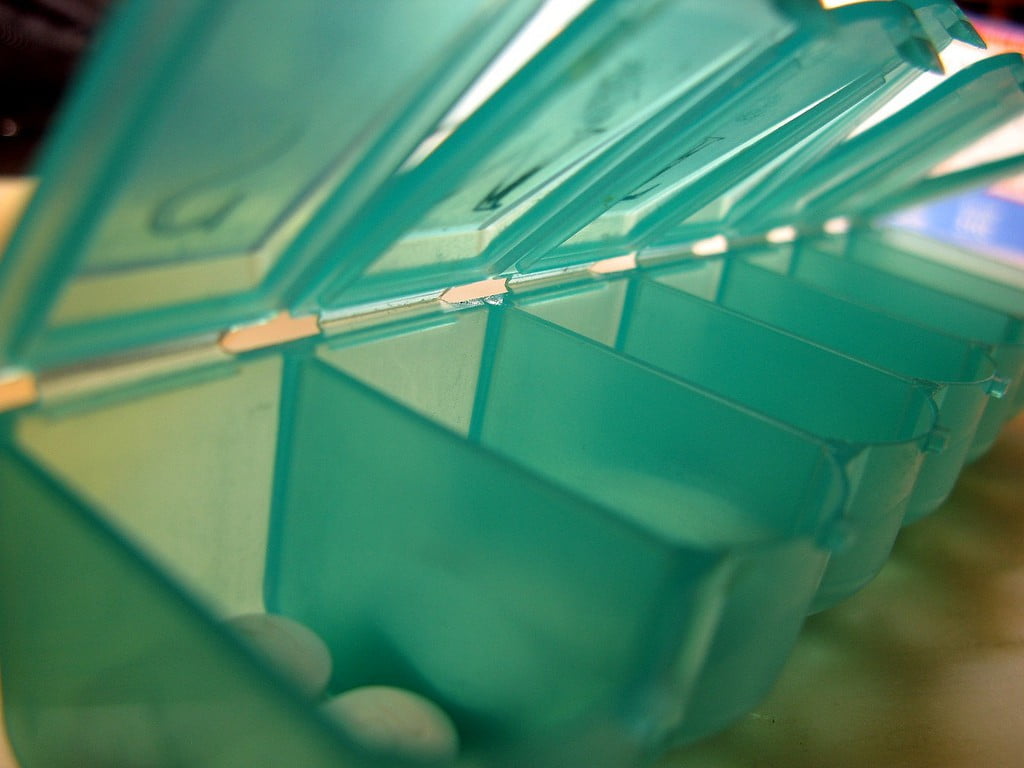

| Part D (Prescription Drug) | Part D adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans. These plans are offered by insurance companies and other private companies approved by Medicare. Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare Prescription Drug Plans. |

[hr_invisible]

Are you eligible for Medicare?

You are eligible for Medicare if at least one of the following applies to you:

- You are 65 years old

- You are permanently disabled

- You have been diagnosed with end-stage renal disease (ESRD)

Eligible individuals can enroll or make changes to their Medicare plans during specific enrollment periods:

- Initial Enrollment Period (IEP): The seven month period in which you may initially enroll, beginning 3 months prior to the month in which you turn 65.

- Annual Election Period (AEP): October 15 through December 7 is the annual open enrollment period when you can make changes to your medical and Part D coverage for the new plan year (January 1 effective date).

- Special Enrollment Period (SEP): Allows for special circumstances such as moving outside your current plan service area, leaving an employer group, and more. See medicare.gov for detailed information.

[hr_invisible]

Medicare Supplement Plans

Original Medicare typically does not cover all of an individual’s health care costs. In order to fill the gap, many individuals purchase a Medicare supplement plan. Medicare supplement plans, also known as Medigap policies, are policies that can be purchased to cover expenses that Medicare does not pay.

The most common supplemental plans provide coverage for your out-of-pocket expenses not paid by Medicare, such as copays, deductibles, coinsurance, as well as some services that may not be covered by Medicare. Plans vary, so you’ll want to choose a plan that provides the coverage you need.

Medicare supplement plans are sold by private insurance companies, and you will usually pay a monthly premium. Insurance companies selling Medicare supplement plans do not need to adhere to the requirements for standard Medicare policies. This means that the cost of Medicare supplement plans can vary due to a number of factors, including the plan’s service area, the age you were when enrolling or the age you currently are when enrolling in a supplement plan. Because premiums and out-of-pocket costs can vary, it is a good idea to shop around to ensure you find the best rate and policy to suit your needs.

Your TCI agent can provide you with Medicare supplement plan quotes to compare, and help answer your Medicare and supplemental coverage questions. Contact us today!