The cost of owning a vehicle can increase significantly when you allow others to drive it. You become responsible for accidents involving your car, whether you’re behind the wheel or not.

Having sufficient car insurance gives you a front-line defense if an accident happens. Your auto insurance company becomes the primary payer for damages and injuries instead of you personally — but only if you’re properly covered for the situation.

Here’s how to make the right insurance decisions in these common scenarios:

[hr_invisible]

Minor Living with You

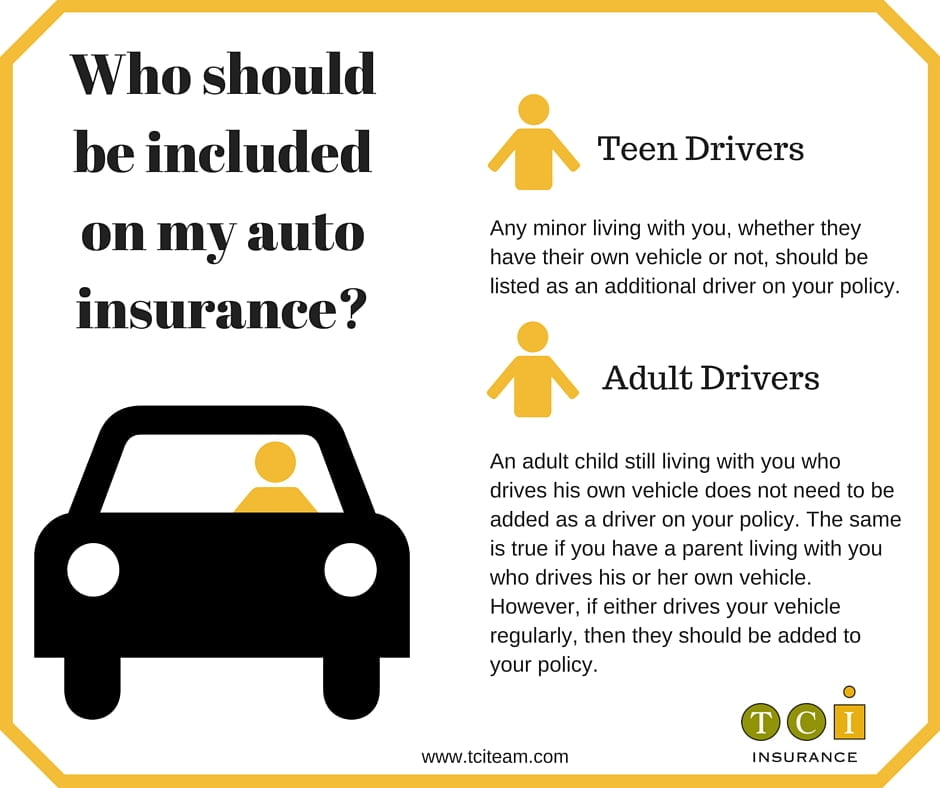

In general, giving consent for your teen to get a license makes you legally responsible for the young driver. It is also your responsibility to contact your insurance agent and get your teenage driver properly covered under your auto insurance policy.

According to the American Academy of Pediatrics, the crash rate for 16-year-olds is almost nine times greater than the general population of drivers. So it’s wise to boost your liability limits when adding a teen driver to your auto insurance policy.

[hr_invisible]

Minor Not Living with You

If your teenager does not live with you permanently, but visits on a regular basis, you will still be required to have him or her listed as a driver on your car insurance policy.

This is true even if your teen lives with another parent who has car insurance because your auto insurance company assumes the teen will drive your car while at your house.

[hr_invisible]

Adult Child Living with You

If your child is over age 18 and has his own car titled in his name, most states won’t hold you responsible if he crashes his car. If your adult child has his own car insurance policy, you shouldn’t have to list him on yours.

[hr_invisible]

Parent Living with You

A parent who lives with you and has his own car should be responsible for the insurance on it. You shouldn’t have to list him on your policy, but you may be required to show proof of his insurance policy to your insurer.

Source: Insure.com

[hr_invisible]

[hr_invisible]

Did You Know?…

- Before lending out your car, you should talk to your insurance agent to make certain your auto policy covers anyone to whom you give permission to drive your vehicle (called permissive drivers).

- If you do lend your car to someone, you should make sure they have a valid driver’s license. Many insurance companies won’t pay claims if the driver’s

license isn’t valid at the time of the crash.